It’s an honor to speak with you today. Why don’t you give us some details about you and your story. How did you get to where you are today?

You know, it’s not your “typical” story of how a financial expert would pursue entering the finance industry— I did not go to post-secondary school and earn a degree in Finance, Economics, Accounting or Financial Planning. In fact, my journey began when I was working as a Practice Manager for an Ear, Nose & Throat specialist in Baltimore, MD. I had worked my way up from temporary job assignments to being promoted as a direct hire, and a few years later, I was promoted to management. It was an achievement that boosted my self-esteem and provided a steady, livable wage, but I knew something was missing: the freedom of time and money. After replacing my full-time income as a part-time, licensed financial services representative, my husband and I made a pivotal decision. We decided to bet on my potential and pursue entrepreneurship full-time. This decision came with its challenges, but it turned out to be one of the best decisions in my professional life. It’s a decision that reflects the essence of empowerment and the belief that there is no such thing as “can’t.” It’s been nearly 15 years of investing in my own personal and entrepreneurial growth to include continued education, licensing and designations in multi-lines of insurance, financial consulting, investment advisory, financial planning and even marketing, branding, leadership and speaker development. I love partnering with clients who, like me, desire more for their life, business and are intentional about legacy building in real-time.

I’m sure your success has not come easily. What challenges have you had to overcome along the way?

Reflecting back to that pivotal decision my husband and I made together to allow me to try entrepreneurship full-time was one of the scariest professional decisions I had made at that point. And even though I started out doing very well as a new entrepreneur with being consistent at the business fundamentals such as time management, learning & development, lead generation, sales-skill mastery, communications, strategic partnerships and relationship building, in less than a year I found myself in financial trouble just like some of my clients had been experiencing. See, I had successfully replaced my income from my previous employer but it was my “only” source of income. I was thriving in steady client appointments, events and referrals but then the lagging effects of the financial crisis of 2008 started hitting my clients and prospects hard. You remember when the reckoning came due to predatory lending practices, unregulated markets, mounting consumer debts and overinflated home values,… Well my appointments and opportunities dried up right before my eyes. We found ourselves pulling from our 401k plans, exhausting our emergency and reserve accounts and I even picked up some hours at my former employer to help make our ends meet— it got bad! And not only that, we had to file bankruptcy, all while I was still a licensed, financial professional! Shame? Guilt? Defeat? Yup, I experienced all those emotions, but I was determined to bounce back, mentally, emotionally, financially. Seasons like this build resilience and perseverance within us, right?

Let’s talk about the work you do. What do you specialize in and why should someone work with you over the competition?

I specialize in teaching my clients how to correctly manage their money and invest in their values so they can live the life they want without worrying about money — and leave an undeniably significant legacy for their children’s children. Partnering with clients who want M.O.R.E from their life and their business, particularly black women in business like me, ignites a fire within me that allows me to brighten up every room, stage and even kitchen table that I am invited to. Living a life of M.O.R.E looks different for each of us. I love watching the light bulb come on or shine brighter when I share my M.O.R.E methodology with my clients. Living an enjoyable life of M.O.R.E could look like- creating great Memories, seizing Opportunities, building healthy Reciprocal relationships, and being Exposed to new experiences! The “how” she gets to a life of more could include a combination of prioritizing financial literacy, improving her financial well-being, optimize her spending and savings plans, minimizing her debt load while maximizing her credit scores, safeguarding her income and assets from the “what ifs” and strategizing the best short, mid and long-term investing and retirement goals. Sounds like a lot! But I pride myself on being a trusted partner and voice of reason on her journey toward financial liberation— reminding her that mastering the financial fundamentals are essential to win!

What’s your best piece of advice for readers who desire to find success?

My best piece of advice for readers who desire to find success is firstly to “define” success; every similar to how one defines more. Do a deep dive within to explore what success looks like and feels like at different “stages” of life. I know my success ideals at 25 were different from what they were at 35 and even now in my 40’s. Our viewpoints about success can and should change and evolve as we evolve. I would recommend setting success goals as it relates to the different “facets” of life also such as health & wellness, mental health, spiritually, socially, professionally, financially and in our family & committed partner relationships. I challenge you readers to also be ok with not knowing exactly what these stages and facets look and feel like. This is all a part of the journal of self-awareness, self-discovery, self-worth and self-love! I bet you’re shocked to hear these things coming from a “financial expert” huh? Well, it’s all relative to discovering and exploring our money stories, relationship with money and even healing from financial traumas that may be holding us back!

Speaking of success, what does the word mean to you?

In my 40’s success means healing, elevation, freedom, joy and gratitude in all areas of my life, nurturing a loving and happy life-long partnership with my husband, being an authentic, positive role-model for my adult children and grandchildren, creating transformational impact in the lives of those who have been entrusted to me to guide financially and in my later days continuing to live and rest in peace and power knowing that “my dash” was intentional and significant.

What’s next for you?

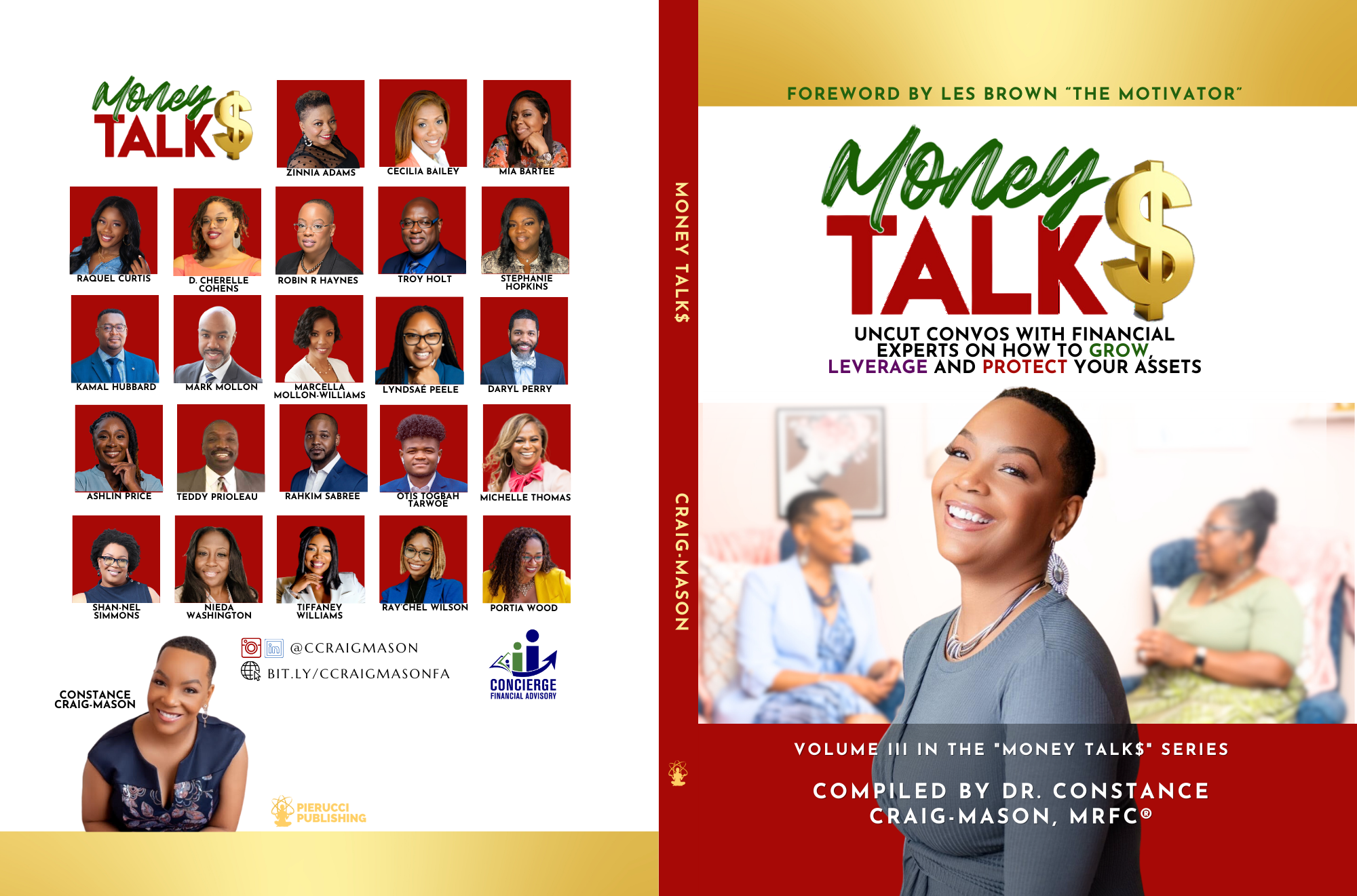

In celebration of National Book Month this October 2023, myself and 23 other accomplished, Black authors are rewriting the narrative of financial empowerment for BIPOC (Black, Indigenous, People of Color) individuals, families, and small business owners. Our groundbreaking literary collective called, “Money TALK$: Uncut Convos With Financial Experts on How to Grow, Leverage, and Protect Your Assets”, is set to revolutionize the way BIPOC individuals, families, and small business owners across the nation approach their finances. “Changing how we view money, assets, and wealth is critical to real financial success. And that’s exactly what the visionary, Dr. Constance Craig-Mason, and the co-authors accomplish with this book. I recommend reading the insights contained within and getting a copy for someone you love,” shares the esteemed motivational speaker and author, Les Brown, from the foreword. As financial literacy becomes an increasingly critical skill, one alarming statistic stands out. According to a 2023 Bankrate report, a staggering 57% of adult Americans are unprepared for a $1,000 emergency. In a world where unforeseen circumstances can arise at any moment, being financially prepared is a necessity.

The primary objective of this book is to help readers establish a $1,000 emergency savings fund, a goal that eludes many households. The book, together with the Paycheck Power BOOSTER® Calculator, makes up the Money TALK$ Emergency Savings Challenge & Tool Kit, which will help individuals and families achieve this crucial financial milestone. To learn more about the Money TALK$ Emergency Savings Challenge & Tool Kit visit www.moneytalkschallenge.com.

Finally, how can people connect with you if they want to learn more?

You can connect with me on all of your favorite social media platforms @ccraigmason, email me at constance@conciergefg.com or call 717-527-3057.